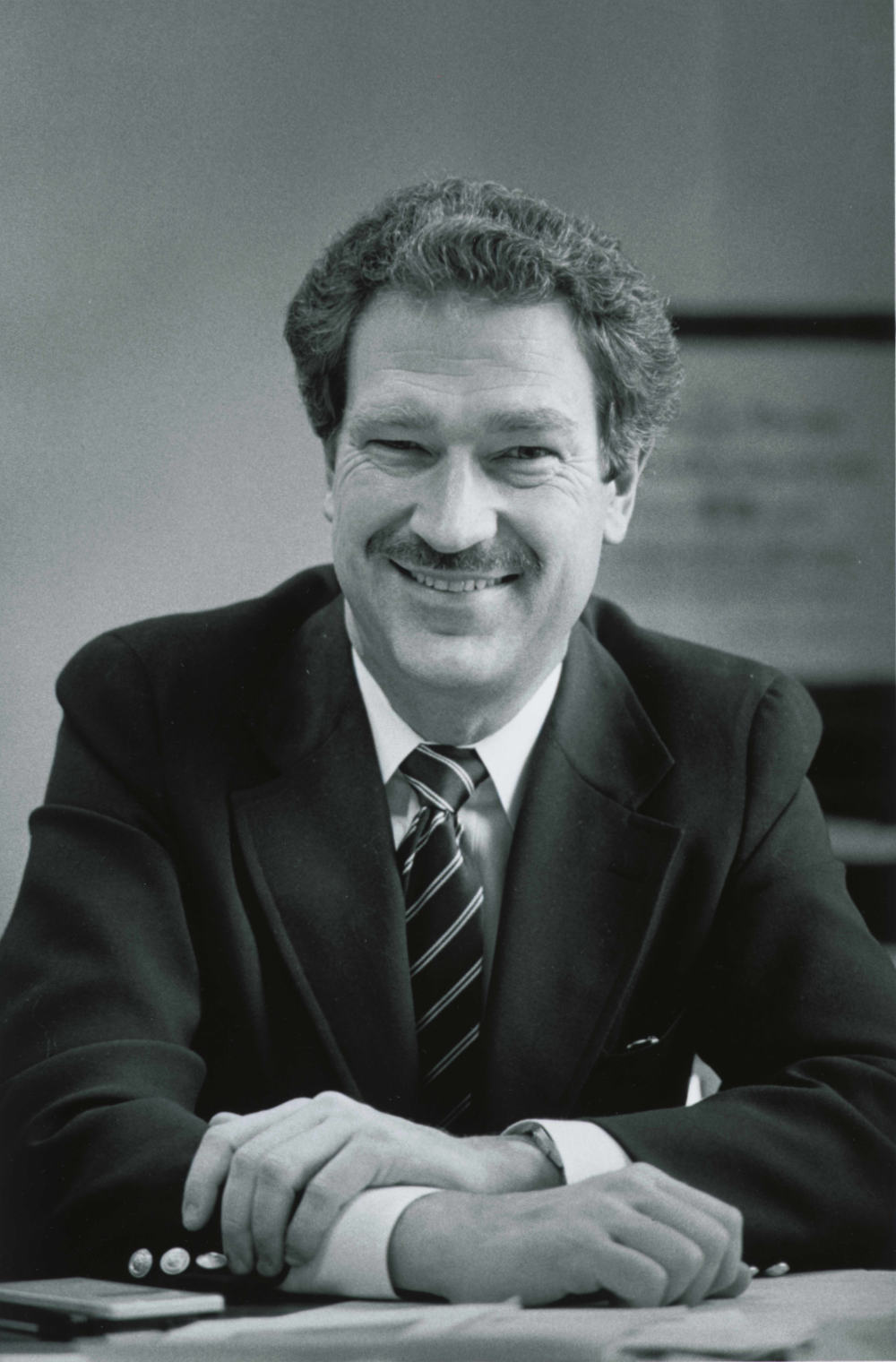

His pioneering research on organizational theory, started at Rochester, has left an enduring mark on the academic and business worlds.

It's hard to overstate the effect economist Michael C. Jensen, the former LaClare Professor of Finance and Business Administration at the University of Rochester, has had on his field and beyond. His pioneering research not only revolutionized the understanding of corporate finance and organizational theory, but also changed the way companies are run.

Jensen, who taught at the University's Simon Business School for two decades from 1967 to 1988, died this month. He was 84.

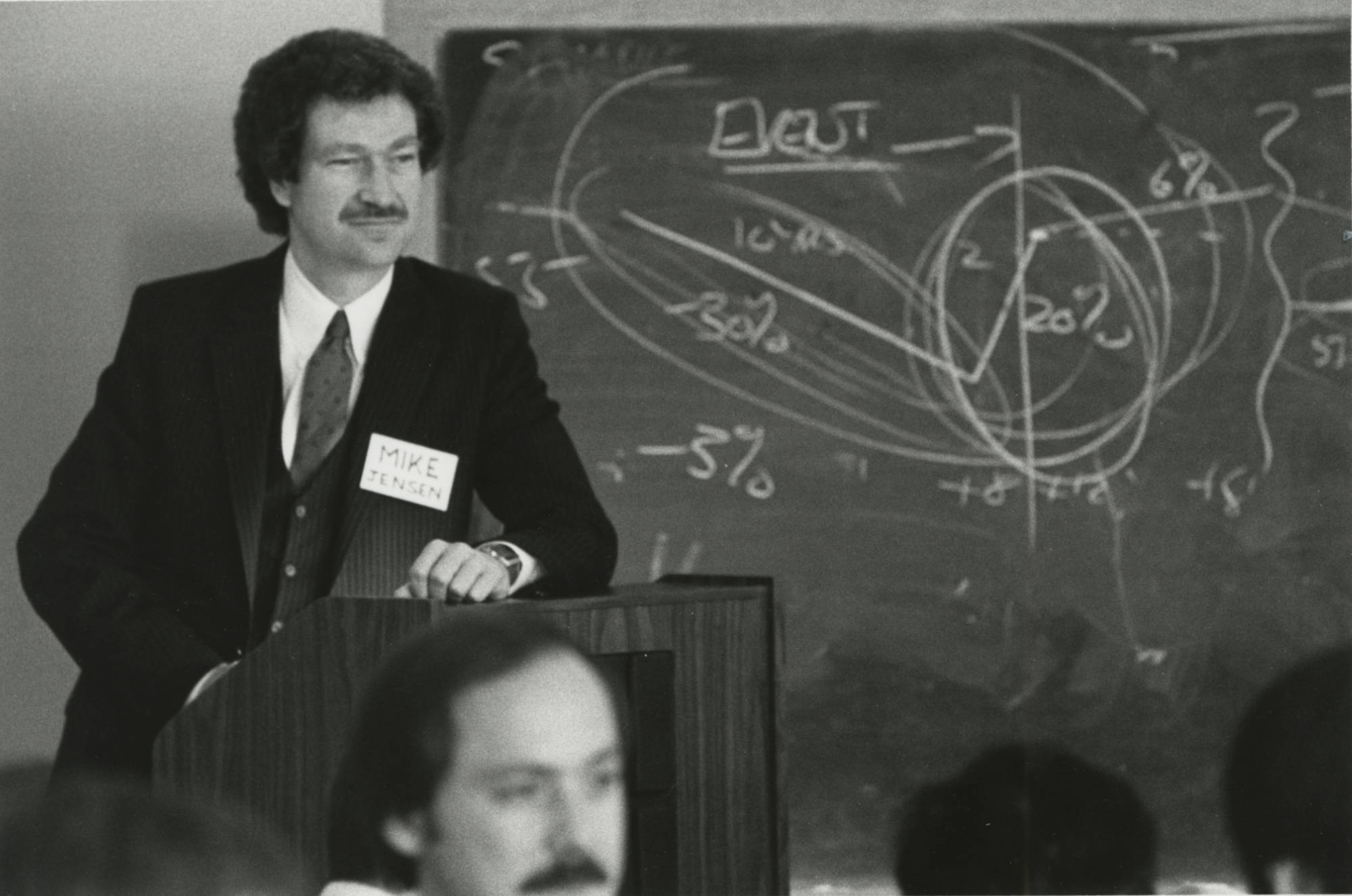

During his tenure at Rochester, Jensen cofounded one of the most prominent peer-reviewed academic journals, the Journal of Financial Economics. He also established the University's Managerial Economics Research Center in 1977, serving as its director before leaving for Harvard University in 1988, where he was eventually named a professor emeritus.

In the world of academia, a high number of citations-when other academics cite your research-is a quantifiable measure of success. Having an invention or idea named after you, and seeing it widely used, is another. Jensen had both.

His total body of work, spanning a handful of books and more than 100 academic papers, racked up more than 340,000 citations on Google Scholar (as of April 2024), making him one of the most influential financial economists of all time. In the late 1960s, he developed what came to be known as Jensen's alpha, a method for calculating the performance of mutual fund managers.

Jensen had fans and detractors. In the words of Adrian Wooldridge, a columnist for Bloomberg Opinion, his critics deemed him "the high priest of the greed-is-good era who justified exorbitant executive pay and vulture capitalism," while his admirers saw "the surgeon who gave Anglo-Saxon capitalism a new lease of life by slicing off the fat, removing the malignant tumors and prescribing a strict exercise regime."

Shooting to economic stardom with the "theory of the firm"

In 1976, Jensen published a seminal paper coauthored with the late William Meckling, then-dean of the Simon School. Neither could have foreseen that the publication, titled "Theory of the firm: Managerial behavior, agency costs, and ownership structure," would become the single most-cited article in business academia.

In the paper, Jensen and Meckling describe a model in which the owners of a company (the "principals") hire executives (the "agents") to steer the company on their behalf. They argued that conflict, especially over costs, was baked into the system, unless the incentives were such that the agents wouldn't try to take advantage of the principals.

Their solution? Make top executives hold an equity stake in the company they helm so that they, too, had a vested interest in the corporation's financial success, trimming away managerial excesses-and sometimes parts of the workforce.

Or as Wooldridge noted plainly: "The more you turn 'agents' into 'principals,' the more you will give them an incentive to squeeze the maximum value out of the companies that they were hired to run."

Jensen and Meckling posited that as the top managers' ownership stakes increased, their interests became more aligned with the interests of the shareholders. It was this central argument, developed further with Jensen's long-time colleague and collaborator Kevin Murphy, that laid the foundation for the widespread use of stock options as executive compensation tools (which has since become a standard component of top managers' pay packages).

"His old classmates at Chicago just thought he was nuts," says Murphy, now a professor of finance and business economics at the University of Southern California's Marshall School of Business, about the business school where Jensen received an MBA and a PhD. "The Chicago way of thinking was that the market should solve everything, and that we'll get to efficiency, as long as the markets are working well. But Mike and Bill disagreed."

Nearly fifty years later, the paper remains "fundamental to understanding the dynamics of modern corporations," notes Sevin Yeltekin, Simon's current dean and a professor of business and economics. "Mike will be remembered not only for his intellectual brilliance but also for his unwavering commitment to advancing knowledge that transformed the way we perceive and practice economics and finance."

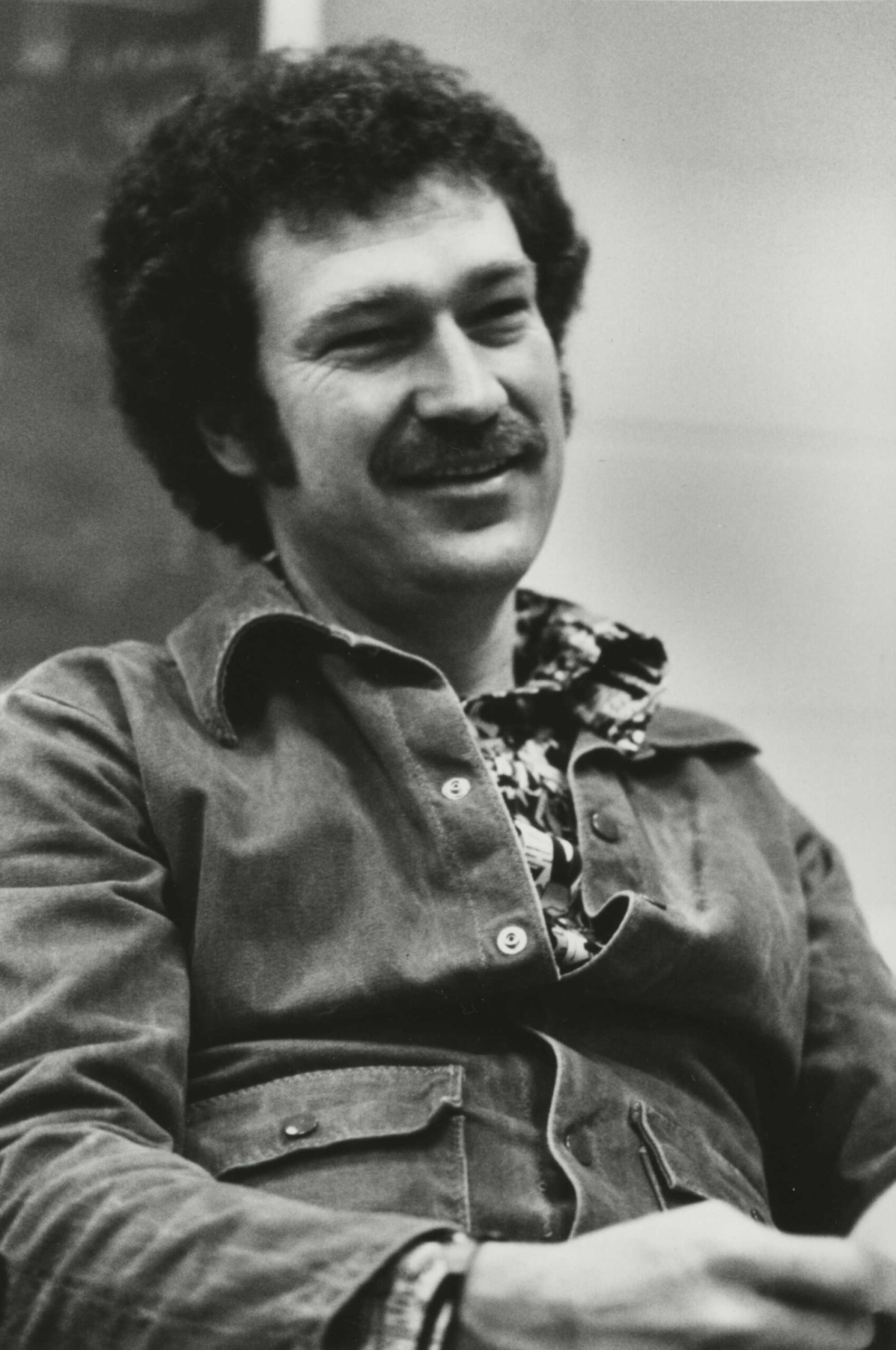

Described by those who knew him as "a force of nature" who brought an "amazing energy" to whatever he undertook, Jensen slept little and rose early. Starting his workday at 4 or 5 a.m., he was known to take short afternoon power naps in his office.

Work was his passion. So were the outdoors. Another one was collecting fine wine.

The proud owner of two large wine cellars in Vermont, one in his main house and another in the guest house, Jensen also had several large wine cabinets installed at his Florida residence. According to friends, even while sipping exquisite wines, his notion of good conversation invariably returned to ideas and economics.

A 40-year collaboration, originating at Rochester

Murphy's and Jensen's four decades-long professional collaboration started at Rochester, when Murphy-a young assistant professor on his first job-cowrote an op-ed for the New York Times with Jensen, who by then was already the Simon School's undisputed superstar.

Other coauthored papers followed, including "CEO incentives: It's not how much you pay, but how" in 1990. "We felt that following the stock price was the right thing to do," says Murphy, explaining their underlying idea that managers needed to be paid, at least partially, in equity or stock options to maximize shareholder value.

But there was a flipside when CEO pay reached stratospheric heights. Jensen and Murphy had advocated for an increase in stock options for the top brass in return for a reduction in other types of compensation. "What actually happened, to our chagrin, was that companies would layer stock options on top of existing competitive pay packages."

Frequently fellow academics, labor unions, or the public at large disagreed with Jensen, who considered takeovers (and hostile takeovers) a fundamentally efficient way to unleash value. He also saw the positives of golden-parachute arrangements that would effectively bribe executives not to resist such takeovers.

At one point, Murphy and Jensen embarked on a hot-button book project with Eric Wruck, who earned an MBA at Rochester, titled CEO Pay and What to Do About It. Due to be published by Harvard Business School Press, the work-in-progress attracted early media interest in 2007, including from the New York Times.

Wruck's untimely death stalled progress on the project, although Jensen and Murphy continued to work on it until 2018. Ultimately, the book failed to come to pass, its chapters appearing instead as a series of academic articles.

In what would have been the last chapter, they warned Congress, in so many words, to butt out: "Our emerging conclusion is that the best way the government can fix executive compensation is to stop trying to fix it, and by undoing the damage already caused through existing regulations that have, in aggregate, imposed enormous costs on organizations, their shareholders, and social welfare."

Putting integrity back into finance

Later in life, Jensen added another dimension to his research-the idea of integrity through the lens of corporate accountability.

In the wake of the infamous corporate fraud cases and subsequent implosions of Enron and WorldCom in the early 2000s, followed by the global financial crisis of 2008, Jensen began advocating for a change in corporate behavior. In 2012, together with Werner Erhard, he argued that integrity was "as important as labor, capital, and technology. Without a clear, concise, and most importantly, an actionable definition of integrity, economics is far less powerful than it can be." The same, the duo wrote, applied to finance and management.

Aware that this position could be perceived as a departure from Jensen's earlier research, the coauthors cautioned readers that because their intention was to "call attention to aspects of life and aspects of finance that are not commonly discussed, or certainly not discussed in the way we will do so here, you are likely to find it strange and even wrong."

An enduring legacy, including as a colleague, mentor, and teacher

Jensen's influence on the academic and business worlds is undisputed.

Several faculty members at Simon, including James Brickley, William Schwert, Clifford Smith, Jerold Zimmerman, Jerold Warner, and John Long, were close colleagues of Jensen's. All of them have become influential in their own right, carrying forward his legacy of groundbreaking research and innovative thinking.

Jensen also left a lasting impression as an educator. Throughout his career, Jensen's teaching and mentorship inspired countless students and colleagues, many of whom went on to build their own successful careers in academia.

One of them is Karen Wruck, now a professor of finance at Ohio State University's Fisher College of Business (and Eric Wruck's widow). Wruck, who received a PhD at Rochester and initially had followed Jensen to Harvard, describes him as "the most intellectually curious and creative person" she has ever worked with. She credits Jensen with teaching her how to "think critically without being closed-minded, and to never give up."

Wruck adds, "Not a day goes by that I do not use some idea, concept, or way of thinking that I learned from him."